The Blueprint for Infrastructure: Building Durable Value in the Real Economy

The Blueprint for Infrastructure: Building Durable Value in the Real Economy

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: market risk, macroeconomic risk, liquidity risk, interest rate risk, and operational risk.

Takeaways

01.

Structural Gaps Create Opportunity

Under current trends, the Global Infrastructure Outlook projects a cumulative global infrastructure investment gap of $15 trillion by 20401, underscoring the need for private capital. Deferred maintenance and modernization create a pipeline of investable opportunities.

02.

Resilient Cash Flows and Inflation Linkage

Many infrastructure assets operate under long-term contracts or regulatory frameworks that may help support stability and inflation linkage.

03.

Diversification Matters

Combining primaries, secondaries, and co-investments can offer diversified access while maintaining alignment and thoughtful fee structures.

Understanding the Infrastructure Landscape

Infrastructure is the backbone of the modern economy— transportation systems, utilities, digital networks, and energy transition projects. At GCM Grosvenor, we define infrastructure as long-lived assets with stable, predictable cash-flow characteristics that underpin daily life and productivity.

Many infrastructure assets operate under concession, contractual, or regulatory frameworks that promote stability and transparency. They play an essential role in daily life—powering homes, moving goods, and connecting people—making them a natural fit for long-term portfolios.

Macro Tailwinds and Market Drivers

Aging Assets: 42% of U.S. bridges are more than 50 years old, underscoring the scale of deferred maintenance.2

Capital Demands: The U.S. alone requires an estimated $2.6 trillion of investment this decade to meet infrastructure needs.3

Expanded Private Capital: Private infrastructure assets under management have increased nearly eightfold since 2010, reaching approximately $1.4 trillion in early 2024.4

Policy and Technology: Energy transition, decarbonization, and digital transformation continue to create new opportunities in power grids, renewables, and broadband.

In developed markets, underinvestment has left many systems aging and undersupplied, while policy shifts and technological change are expanding the investable universe. These structural forces have positioned private capital as an increasingly vital partner in modernizing the real economy.

Why Private Infrastructure?

Infrastructure assets can serve as a meaningful component of diversified portfolios, offering exposure to essential services and long-duration cash-flow characteristics.

Historically, private infrastructure has exhibited features that may support portfolio resilience and complement other private market allocations.

FIGURE 1: $15T GLOBAL FUNDING GAP BY 20405

$3.3T GLOBALLY

$2.6T U.S.

$10.0T U.S.

$1.2T U.S. “BIL” of 2021

Priority of the Bipartisan Infrastructure Law is funding towards transportation, energy, and climate infrastructure projects9

FIGURE 2: WHY PRIVATE INFRASTRUCTURE? POTENTIAL FOR:

Consistent income and appreciation

Low correlation

Inflation mitigation

Reduced volatility

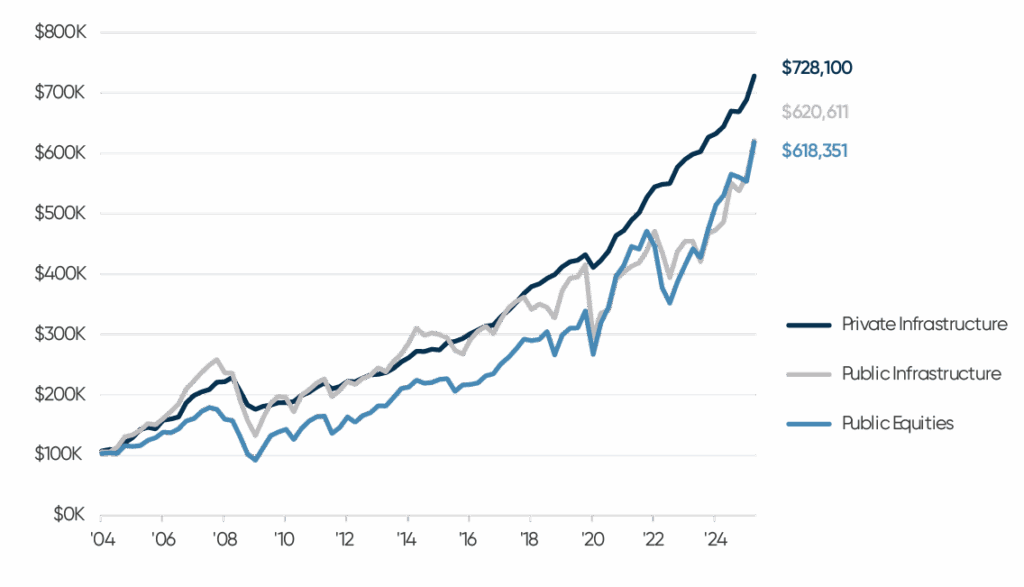

FIGURE 3: THE CASE FOR PRIVATE INFRASTRUCTURE - GROWTH OF $100,000 (2004-2024)10

10. SOURCES: BURGISS; MSCI. Private Infrastructure data from MSCI Global Private Infrastructure Closed-End Fund Index (Frozen; USD); Public Infrastructure data from MSCI Core Infrastructure Index (USD); Public Equities represented by Burgiss Infrastructure PME benchmark using the MSCI ACWI Index (USD) as the public market proxy. Data as of June 30, 2025.

INFRASTRUCTURE CORE THEMES

While each sector has distinct fundamentals, all share the characteristics of durability, demand resilience, and the potential for long-term capital deployment.

Digital and Connected Infrastructure

As global data consumption accelerates, demand for connectivity continues to surge. Investments in data centers, towers, fiber networks, and logistics assets are expanding the backbone of the digital economy—enabling innovation, supporting commerce, and powering the flow of information and goods worldwide.

Energy Transition and Infrastructure Adjacencies

The path to decarbonization and energy security is fueling opportunity across renewable generation, natural gas, and energy efficiency. At the same time, the rise of smart infrastructure, battery storage, and EV charging is reshaping what “infrastructure” means—broadening the market to include essential, technology-enabled assets with durable demand.

Transportation and Essential Services

From airports and toll roads to ports, bridges, and rail, transportation networks are being rebuilt to meet modern needs. Investment is vital to replace aging systems, strengthen resilience, and support the shifting patterns of population, mobility, and trade that define the global economy.

These sectors combine stable demand with opportunities for modernization and innovation, allowing investors to tailor exposures across growth and defensiveness.

THEMATIC FOCUS

We target sectors that blend essential demand with growth and innovation:

- Connectivity: Data centers, fiber, logistics, and supply chain assets.

- Transition: Renewable generation, natural gas, energy efficiency, and energy security.

- Mobility: Airports, toll roads, rail, and terminals

Scale, Discipline, and Partnership

Our scale enables disciplined portfolio construction and robust governance while maintaining selectivity. We emphasize co-investments and single-asset secondaries to provide fee-efficient, direct exposure alongside experienced sponsors—delivering differentiated opportunities with strong alignment and oversight.

Platform Strength and Relationships

GCM Grosvenor’s infrastructure strategy draws on the breadth of our platform and long-standing relationships with specialist managers:

- Deal Flow at Scale: $25 billion committed to infrastructure since inception in 2005, sourcing more than 3,000 investments.

- Selective Underwriting: Thousands of deals reviewed annually, with only the most compelling advancing—a roughly 8% selection rate (per our DDQ).

- Fee Efficiency: Co-investments and continuation vehicle/single-asset secondaries help reduce or eliminate incremental fees, enhancing alignment.

- Evergreen Expertise: Decades of experience managing perpetual vehicles support disciplined liquidity management and governance.

THE CO-INVESTMENT ADVANTAGE

Co-investments can complement fund commitments by providing additional access to specific assets. Many are structured with reduced or no incremental management fees, enabling allocators to participate directly alongside experienced sponsors.

This approach can enhance alignment and transparency by offering deeper insight into underwriting assumptions, operational considerations, and governance practices— factors that we believe contribute to informed decision-making in private markets.

FIGURE 4: CO-INVESTMENTS: A MORE EFFICIENT PATH TO VALUE11

| Control Only Fund | Co-Investment Strategy | |

|---|---|---|

| Management Fee | 2% | 0% (Fund charges 1%) |

| Carry | 20% | 0% (Fund charges 10%) |

11. Source: GCM Grosvenor. Illustrative and hypothetical example for discussion purposes only. Not based on actual GCM Grosvenor investments or client portfolios

CLOSING PERSPECTIVE

Infrastructure represents an essential segment of the real economy, one characterized by long asset lives, stable demand, and evolving opportunities tied to technology and sustainability. A disciplined, multi-channel investment approach can help investors achieve diversified exposure to these long-term themes while emphasizing prudence and partnership.

1. Source: Global Infrastructure Hub, Global Infrastructure Outlook, 2018.

2. Source: American Society of Civil Engineers. (2021). 2021 Report Card for America’s Infrastructure: Bridges.

3. Source: American Society of Civil Engineers. (2021). 2021 Report Card for America’s Infrastructure: Executive Summary

4. Source: Global Infrastructure Hub. (2024). Infrastructure Monitor 2024: Section 2 – Infrastructure Funds. Sydney, Australia: Global Infrastructure Hub.

5. Source: Global Infrastructure Hub, Global Infrastructure Outlook, 2018.

6. Source: McKinsey & Co.

7. Source: American Society of Civil Engineers

8. Source: Council on Foreign Relations

9. Source: U.S. Department of Treasury

10. Sources: BURGISS; MSCI. Private Infrastructure data from MSCI Global Private Infrastructure Closed-End Fund Index (Frozen; USD); Public Infrastructure data from MSCI Core Infrastructure Index (USD); Public Equities represented by Burgiss Infrastructure PME benchmark using the MSCI ACWI Index (USD) as the public market proxy. Data as of June 30, 2025

11. Source: GCM Grosvenor. Illustrative and hypothetical example for discussion purposes only. Not based on actual GCM Grosvenor investments or client portfolios

Important Risk Information

For illustrative and discussion purposes only. No assurance can be given that any investment will achieve its objectives or avoid losses. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/ operational risks, and may result in the possible loss of your entire investment. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions, and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

GCM Grosvenor® and Grosvenor® are trademarks of GCM Grosvenor and its affiliated entities. ©2025 GCM Grosvenor L.P. All rights reserved.